The financial services sector is at the forefront of digital transformation. With increasing customer expectations, stringent regulatory requirements, and the rising sophistication of cyber threats, leveraging the right technology is critical for operational efficiency, security, and competitive advantage.

From cloud computing and AI-driven analytics to cyber security frameworks and automation, financial institutions must embrace innovation to stay ahead. However, the adoption of technology also introduces risks that must be proactively managed.

What Are Information Technology Risks in Financial Services?

While technology enables growth and efficiency, financial organisations must navigate a diverse range of IT risks. These include:

- Data Breaches and Cyber Threats: Financial institutions are prime targets for cybercriminals due to the vast amounts of sensitive data they handle. Phishing attacks, ransomware, and insider threats pose significant challenges.

- Regulatory Non-Compliance: Financial firms must adhere to strict regulations, such as GDPR, PCI DSS, and FCA guidelines. Failure to comply with data protection and security requirements can result in severe fines and reputational damage.

- System Downtime and Service Disruptions: Technology failures—whether due to software glitches, hardware malfunctions, or third-party service outages—can lead to operational disruptions, impacting customer trust and financial performance.

- Third-Party Risks: Many financial institutions rely on third-party vendors for cloud services, payment processing, and data analytics. Without proper risk assessments, these partnerships can introduce vulnerabilities into an organisation’s IT ecosystem.

- Fraud and Identity Theft: Advanced fraud techniques, such as deepfake technology and synthetic identity fraud, challenge traditional fraud detection systems, necessitating the use of AI-driven security solutions.

Addressing these risks requires a robust IT strategy, with cyber security at its core.

Cyber Security Measures for Financial Services

Given the volume of transactions and sensitive data involved, financial institutions must implement stringent cyber security measures, including:

- Zero Trust Security Model: This approach requires continuous verification of users, devices, and applications, ensuring that access is granted based on identity and context rather than assumed trust.

- Multi-Factor Authentication (MFA): Strengthening access control through MFA reduces the risk of unauthorised account access and credential theft.

- Encryption and Data Loss Prevention (DLP): Encrypting data at rest and in transit safeguards sensitive financial information from cyber threats and accidental leaks.

- Regular Security Audits and Compliance Checks: Conducting routine audits ensures that financial firms meet regulatory requirements and detect vulnerabilities before they can be exploited.

- Threat Intelligence and AI-Driven Security Monitoring: AI-powered security solutions can proactively detect and mitigate threats by analysing patterns and anomalies in real time.

- Employee Cyber Awareness Training: Since human error remains one of the leading causes of security breaches, continuous cyber awareness training is crucial to preventing phishing and social engineering attacks.

Adapting To AI In Financial Services

Artificial intelligence (AI) is reshaping technology for financial services by enhancing efficiency, accuracy, and customer experience. Key areas where AI is driving transformation include:

- Fraud Detection and Risk Management: AI-powered analytics can detect fraudulent transactions in real time, minimising financial losses and improving compliance.

- Automated Trading and Portfolio Management: Machine learning algorithms enable predictive analytics for market trends, helping financial institutions make data-driven investment decisions.

- Customer Service and Chatbots: AI-driven chatbots and virtual assistants enhance customer engagement, providing instant responses to inquiries and automating routine banking tasks.

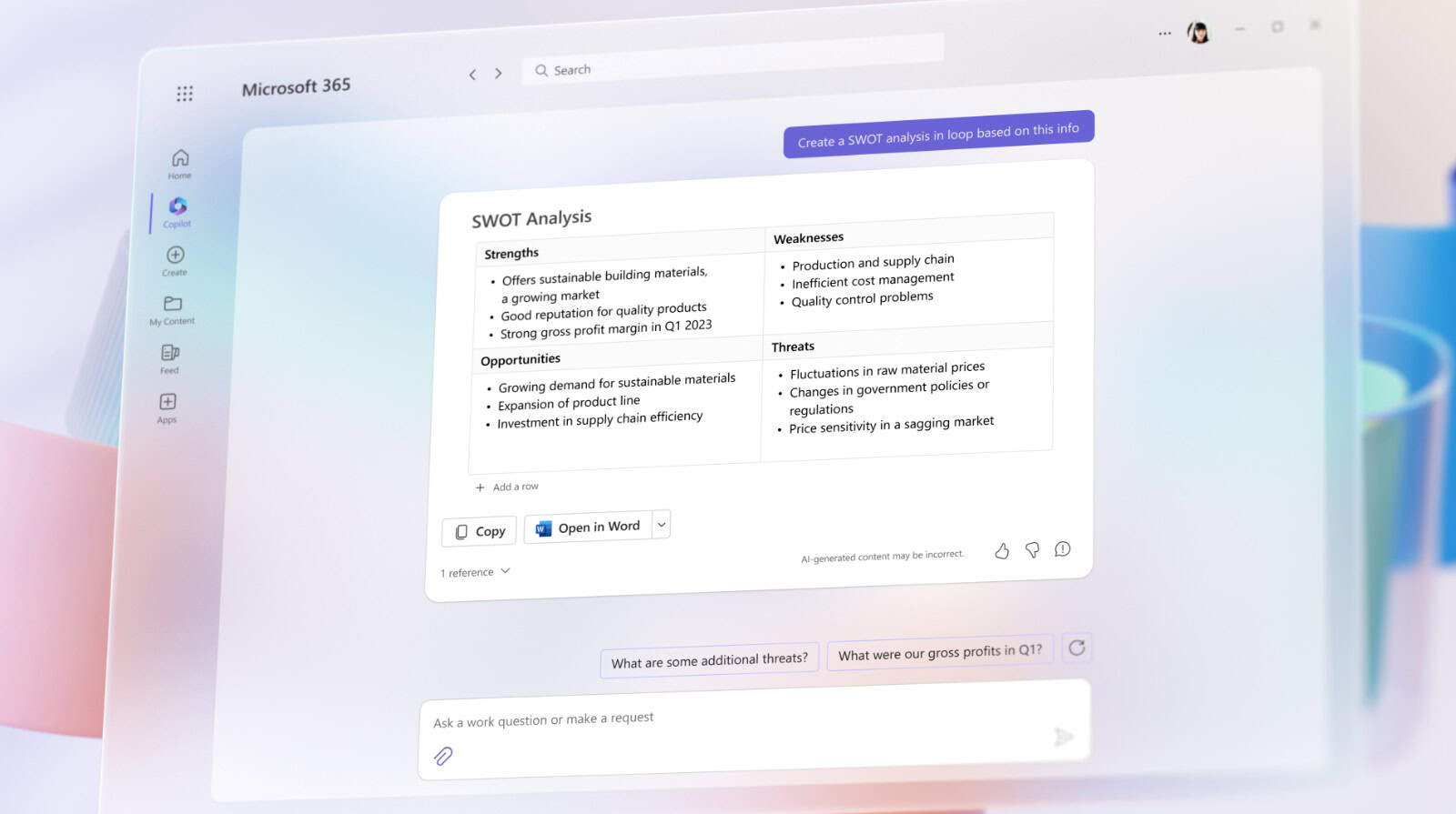

- RegTech and Compliance Automation: AI-driven regulatory technology simplifies compliance monitoring and reporting, reducing manual workload and improving accuracy.

- Personalised Financial Services: AI analyses customer data to offer personalised financial products and services, improving customer retention and satisfaction.

However, as AI adoption grows, financial institutions must address ethical concerns, regulatory scrutiny, and potential biases in AI-driven decision-making.

Choosing An IT Partner That Understands Technology For Financial Services

To navigate the complexities of IT risks, cyber security challenges, and AI-driven innovations, financial institutions need expert IT support.

At Akita, we provide strategic IT solutions and tailored technology for financial services, ensuring compliance, security, and efficiency.

Our advanced and proactive approach to IT risk management, cyber security, and emerging technology adoption enables financial organisations to stay ahead of evolving threats while maximising operational resilience.

Discover how Akita can enhance your financial IT strategy:

Contact Us