Cyber security is growing as a priority among organisations. Through high-profile examples, organisations are coming to understand the potential financial and reputational damage of a data breach.

One of the highest priority areas of security protection is around the taking of payment card transactions. While security here is supposedly enforced by PCI DSS regulation, many organisations are still in the dark about their obligations.

Below we’ve produced a guide to PCI DSS compliance, and why PCI scanning it is crucial for businesses handling card payments.

What is PCI DSS Compliance?

PCI DSS (Payment Card Industry Data Security Standard) compliance is a set of security standards for payments. Developed by banks and credit card organisations, it’s designed to ensure that all companies that accept, process, store, or transmit credit card information maintain a secure environment.

The standards laid out by PCI DSS aim to protect cardholder data and reduce credit card fraud. There are a couple of measures that organisations need to undertake, chief among them being PCI scanning.

What Is PCI Scanning?

PCI scanning is one of the central parts of PCI DSS compliance.

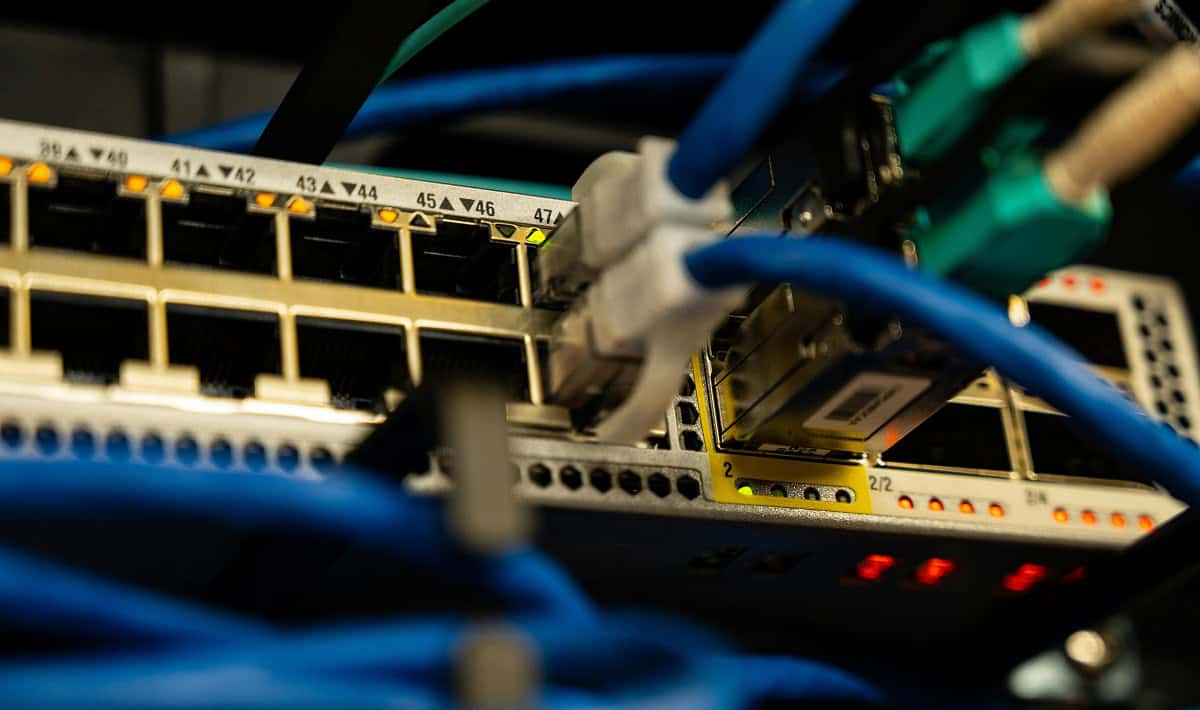

It involves an external organisation (such as Akita) performing a software-based vulnerability scan on an organisation’s network to assess setup and configuration of a network.

A PCI scan will look open ports – externally exposed parts of your network – as well as non-compliant or unsecured systems and hardware.

As part of PCI DSS compliance, organisations are required to submit a confirmed clean PCI scan.

How Often Do I Need to Undertake PCI Scanning?

The frequency of PCI scanning depends on the level of your business’s PCI compliance requirements.

Generally, businesses must conduct PCI scans every quarter. However, it’s advisable to undertake PCI scanning following any significant changes to your network or infrastructure, such as adding new systems or software updates. This is particularly the case when businesses merge as well.

Regular PCI scanning helps organisations identify and mitigate potential vulnerabilities that could exploited by cybercriminals. It also aids in the upkeep of regulatory compliance measures, including ISO 27001 and Cyber Essentials, as any issues with systems are regularly checked for.

What Happens if An Organisation Fail a PCI Scan?

If vulnerabilities are detected as part of a PCI scan, businesses must address these issues promptly. Failure to do so can result in non-compliance penalties, including fines and increased transaction fees.

Repeated failures of PCI scans can damage a business’s reputation. In extreme cases this may result in banking organisations withdrawing card transaction services, or even wider banking services.

This in turn can have a serious impact on an organisation’s credit rating. It’s therefore crucial to take immediate action to resolve any issues highlighted in a PCI scan.

PCI Scanning With Akita

As a leading IT managed service provider and cyber security leader, Akita is well-placed to deal with PCI DSS requirements

With our PCI scanning services, we’re able to assist organisations in staying compliant with PCI DSS. Our services also include the consultancy guidance that relates to security standards to protect cardholder data.

Should an organisation fail a PCI scan, our team of security consultants and IT infrastructure experts can recommend how remediation can be put in place, and undertake measures as required.

Need more information on PCI DSS compliance or PCI scanning? Get in touch:

Speak To Us About PCI Scanning